The Largest National Study on Community Land Trusts and Nonprofits with Shared Equity Homeownership Programs was recently completed. Vince Wang, Ph.D., assistant professor of real estate, was part of the research team.

Category: Research

Governor Inslee makes second visit to College of Built Environments in 18 months

Governor Inslee recently visited the College of Built Environments, where he met with several faculty members to discuss their research and its relevance to his proposal to increase investment in affordable housing.

Finding Your Place: How unaffordable housing drives homelessness

Gregg Colburn, assistant professor of real estate, joined NPR’s Marketplace Morning Report to discuss the common myths believed to be the primary drivers of homelessness versus the actually demonstrated linkages between housing demand and pricing despite the varied wealth of cities. | Marketplace Morning Report

Acolin Awarded NIH R21 Grant to Study Gentrification, Mobility, and Health

Arthur Acolin, Associate Professor and Bob Filley Endowed Chair in the Runstad Department of Real Estate, was recently awarded an NIH R21 grant for his project entitled ‘Gentrification, Mobility, and Exposure to Contextual Determinants of Health.’

Seattle’s cooling real estate market widens budget shortfall

Steven Bourassa, chair of the Runstad Department of Real Estate, explains the impact of Seattle’s housing market on the city’s budget.

What would it take to bring Seattle home prices down to earth?

Arthur Acolin, assistant professor of real estate, talks about the theoretical impact a sufficient supply chain could have on home prices. | Crosscut

One Easy Fix Could Shave Years Off Seattle’s Affordable Housing Developments

Professor Greg Colburn’s recently published book “Homelessness is a Housing Problem” is discussed in the context of affordable housing and King County’s plan to tackle homelessness in Seattle. | The Stranger

New book highlights link between homelessness, lack of affordable housing

Gregg Colburn, assistant professor of real estate discusses the root causes of homelessness. | KPBS

What’s at the Root of Homelessness? A Lack of Affordable Housing

Gregg Colburn encourages readers of his new book to examine a major factor contributing to homelessness – lack of affordable housing. | Planetizen

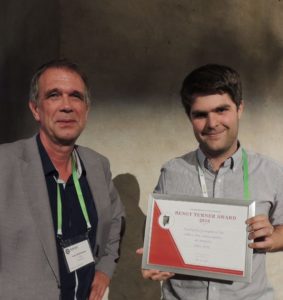

Arthur Acolin receives the Bengt Turner Best Paper Award at the ENHR conference

Congratulations to Arthur Acolin, Assistant Professor in Real Estate, who received the Bengt Turner Best Paper Award at the recent European Network for Housing Research (ENHR) conference in Uppsala, Sweden.

The paper, titled “Tenure Trajectories of Immigrants and their Children in France: Between Integration and Stratification”, found that while immigrants are significantly less likely to be homeowners the gap in home-ownership between second generation immigrants and the rest of the population is smaller and not statistically significant. This suggests a progressive integration in the housing market over time and over generations. However, children of immigrants from some countries continue to exhibit a residual home-ownership gap that require specific policies to avoid durable inequalities in access to home-ownership.